The Real Talk: When Six Figures Don’t Feel Rich Anymore

Let’s be honest — ₹1 lakh used to sound like a dream income once.

But today? It barely lasts the month.

Every time I talk to friends or clients earning six figures, I hear the same thing:

“I make good money, but I still feel broke.”

It’s frustrating, right? You’re working hard, maybe even saving a bit, yet somehow the math doesn’t add up. The truth is, it’s not about how much you earn — it’s about how your salary system works (or doesn’t).

Most of us were never taught salary planning in India.

We learn how to earn, not how to manage.

So we end up building lifestyles around paydays instead of building systems that create peace.

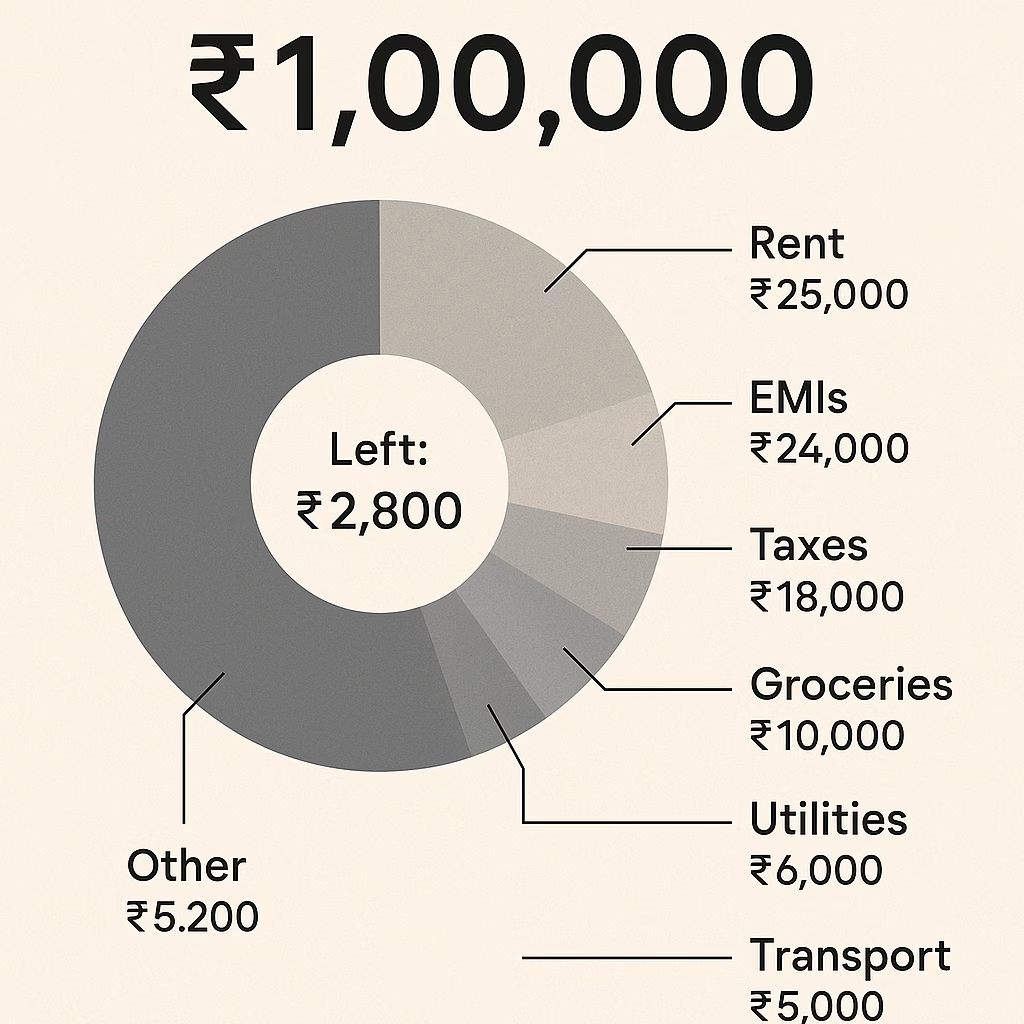

💡 The ₹1 Lakh Illusion: The Money That Disappears Quietly

Let’s do some simple math.

Your monthly salary: ₹1,00,000

After tax and PF deductions: around ₹85,000 in hand.

Now start slicing it up —

- ₹25,000 rent

- ₹15,000 EMI

- ₹10,000 groceries

- ₹5,000 utilities

- ₹6,000 food delivery + outings

- ₹3,000 subscriptions and apps

And suddenly, you’re down to ₹20,000, wondering where it all went.

That, my friend, is lifestyle inflation — the silent thief that follows every raise. The more we earn, the more we “upgrade,” often without realizing it. A new gadget here, a better car there, one quick weekend trip — and poof, your income vanished.

This isn’t a lack of discipline. It’s a lack of salary planning clarity.

No one told us that even a 6-figure income can feel small if it’s not structured with intent.

🧾 The Hidden Salary Trap: It’s Not the Bills, It’s the Leaks

When I first started tracking my expenses, I was shocked. ₹4,500 on random subscriptions. ₹6,000 on “tiny” online orders. A few impulse spends here and there — together, it was almost a full EMI every month.

Most people don’t go broke because of one big expense. It’s death by a thousand leaks.

We call this cash-flow blindness.

You can’t fix what you don’t measure.

If you want to start somewhere, pull up your last 3 bank statements. Mark where every rupee went.

You’ll see patterns — habits, triggers, small conveniences that add up to massive waste.

That’s the first step to better salary planning India — not a new budget app, but awareness. Once you see where the money goes, you start taking control back.

🏦 Banking Secrets the Average Professional Never Learns

Here’s something I learned while working in wealth management: banks love predictable people.

Because predictable spenders are easy to profit from.

But here’s the twist — you can flip the same system to your advantage.

The first rule? Pay yourself first.

Before rent, before EMIs, before groceries — automate a chunk (even 25–30%) of your income straight into a separate account the day salary hits.

Bankers call this salary split.

It’s how wealthy clients quietly grow money — by building automated habits instead of relying on willpower.

Here’s a simple structure that actually works for Indian professionals:

- Main Account (Spend) — daily expenses, bills, cards.

- Growth Account (Save & Invest) — SIPs, insurance, mutual funds.

- Freedom Account (Enjoy) — travel, family, peace fund.

Use tools like Fi Money or INDmoney to automate this.

They let you see your salary flow clearly — where it lands, where it leaks, and where it grows.

Once automation starts working for you, it feels like magic. You stop chasing your money because it’s already moving in the right direction.

⚙️ The 3-Bucket Salary Planning System (The One That Actually Works)

I’ve tried every budgeting style — and this is the only one that sticks.

| Bucket | Purpose | Share of Income | Example (₹1L salary) |

|---|---|---|---|

| Essentials | Rent, EMIs, utilities, bills | 50% | ₹50,000 |

| Growth | SIPs, insurance, savings | 30% | ₹30,000 |

| Freedom | Fun, learning, family time | 20% | ₹20,000 |

This isn’t a strict rule — it’s a flexible base.

If your rent is lower, shift a bit more to “Growth.”

If your EMIs are high, aim to rebalance slowly.

The point isn’t perfection. It’s awareness.

That’s what separates chaos from clarity in salary planning India.

Use a Notion template or the INDmoney dashboard to track it. Seeing your 3 buckets visually each month keeps you grounded — and confident.

🌿 Lifestyle Upgrades That Don’t Break Your Budget

Now, let’s be real — saving money doesn’t mean cutting joy.

You can still upgrade your life, travel, buy good things, enjoy weekends. The key is spending with awareness.

One rule I follow: Peace over prestige.

I’ll happily skip a fancy dinner out if it means investing that ₹2,000 into my “peace fund.”

Because that fund buys me calm — a sense of control that no gadget can replace.

So here’s what to try:

- Spend on skills, not just stuff.

- Automate small joys like a monthly “freedom transfer” instead of random swipes.

- Use value-based spending — if it saves time or improves your health, it’s usually worth it.

That’s how real financial freedom for Indian professionals begins — not by earning crores, but by spending smarter.

💼 The 30-Day Fix: How to Build a Salary Surplus System

If you want a simple reset, here’s what I tell my clients:

- Audit your last 3 months of income and spending.

- Divide your salary into 3 accounts (Spend, Save, Invest).

- Automate the transfers — don’t rely on memory.

- Track weekly using INDmoney or Fi.

- Redirect surplus into a “Peace Fund.”

That fund becomes your emotional safety net — the reason you stop stressing about money.

Give this system 30 days. You’ll notice fewer money surprises. In 90 days, you’ll notice peace.

That’s what being “passively rich” really means — not having to think about money all the time.

🧭 Wrapping It Up: Your Salary Isn’t the Problem. Your System Is.

You don’t need another motivational quote about money.

You need a plan that works quietly in the background.

₹1 lakh can build real freedom if you stop managing it emotionally and start managing it systematically.

Try this approach for a month. You’ll never look at payday the same way again.

And if this article helped you see things differently, do this one small thing —

📩 Join The Weekly Compounder — one short, calm money idea every Friday.

You’ll start loving your salary again — not for what it buys, but for the peace it builds.

💡 Final Takeaways

- Salary planning in India is more about structure than sacrifice.

- Automation beats motivation every single time.

- Banks profit from chaos — so you should build clarity.

- Tools like INDmoney, Fi, and Notion can simplify everything.

- Even ₹1 lakh can create freedom — if you tell it where to go.